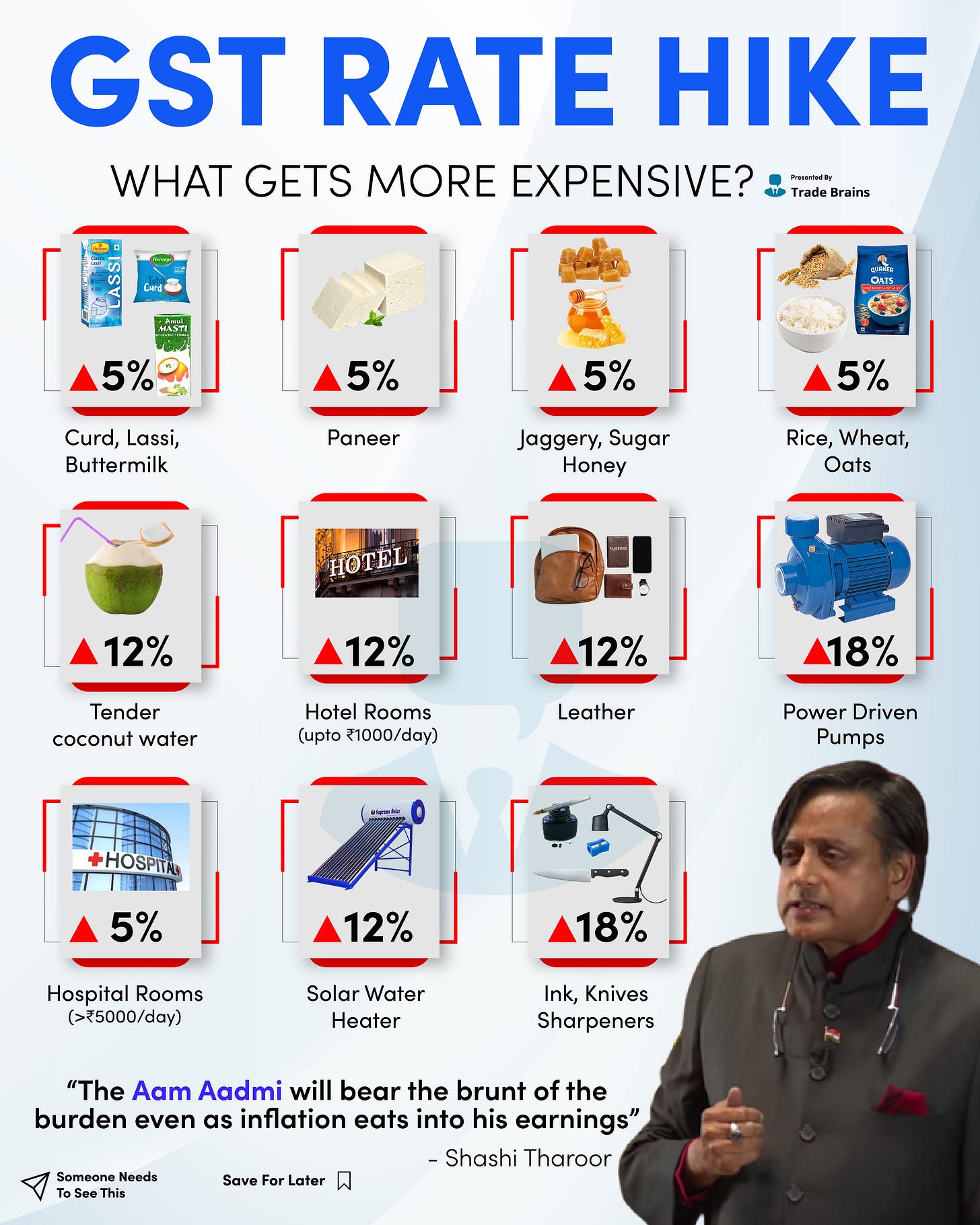

The newly revised GST is effective from today; Here’s what gets expensive!

From July 18, household essentials like curd, buttermilk, paneer, natural honey, rice, wheat, barley, oats among others will become expensive.

Before we get into what products and services are being affected, let’s look at why the revision took place.

The GST council stated that the revision is aimed at correcting the ‘inverted duty structure’, which refers to a situation where taxes paid on goods produced(sales) are lower than the taxes charged on inputs. In such a case, the Government has to refund most of the tax collected. In order to improve this system, a revision was thus brought forward.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐠𝐞𝐭𝐭𝐢𝐧𝐠 𝐞𝐱𝐩𝐞𝐧𝐬𝐢𝐯𝐞?

- Pre-packaged and labelled food (curd, paneer, cereals, flour, etc) which were exempted will now attract 5% GST

- Hotel rooms charging lesser than ₹1000/ day will now have 12% GST as against the exemption earlier

- Non-ICU hospital beds with rent above ₹5000/day at 5% GST

- Issuance of bank cheques attracts 18% GST

- LED lamps, lights, fixtures, ink, and any sort of cutlery will be charged 18% GST as compared to the 12% slab earlier

- Solar water heaters now come with 12% GST, the rate of which was 5% earlier

- Maps and charts will be charged a GST of 12%

- Diamonds will be taxed at 1.5% GST as opposed to 0.25% earlier

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐠𝐞𝐭𝐭𝐢𝐧𝐠 𝐜𝐡𝐞𝐚𝐩𝐞𝐫?

- Ropeway traveling attracts only 5% GST as compared to the previous 12%

- Renting of goods carriage and trucks comes with 12% GST, reduced from 18%

- Air travel to and from north-eastern states has GST exemption

- Medical equipment like ostomy and orthopaedic now attract 5% instead of 12%

What are your thoughts on this revision? Comment below.